Protecting yourself and your family

When you die – and hopefully we’re talking years from now – having the right policy in place can help your loved ones recover financially from the loss.

There are different types of life insurance, but they generally fall under two broad categories: term and permanent.

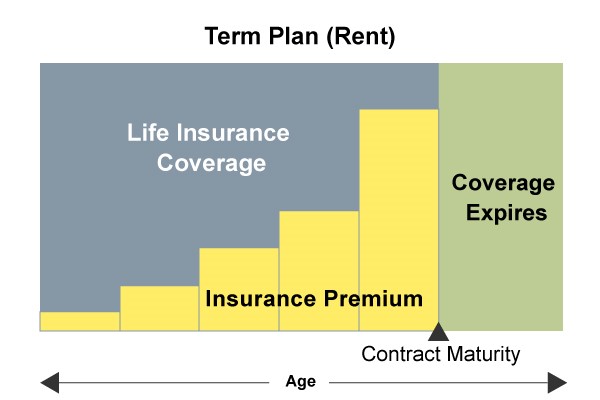

Term life insurance is what it sounds like – life insurance for a defined period of time (rent it). Could be 20 years, could be 30, or virtually any length of time. If you die during the term, your beneficiary will receive the death benefit. If you don’t die during the term, well, that’s good! But, you don’t get any money back after expiry.

Renting Life Insurance The first and most important decision is to cover off your debt and lost income if something were to happen in the short to mid-term. This is called term insurance. Think of this like anything you rent (Car, House, Boat, Skis). You pay a lower amount than purchasing the item outright and when you don’t need it anymore or your rental time is up, you give it back. That is it. Term insurance is the exact same. You pay a lower amount for access to a higher amount of coverage because you hope you don’t have to use it. You can lock in term (rental) rates anywhere from 5-50 years depending on your situation.

Highlights:

- Low initial cost

- Pays out only if the insured dies

- Rates usually go up after the term

- Plan expires at a certain age

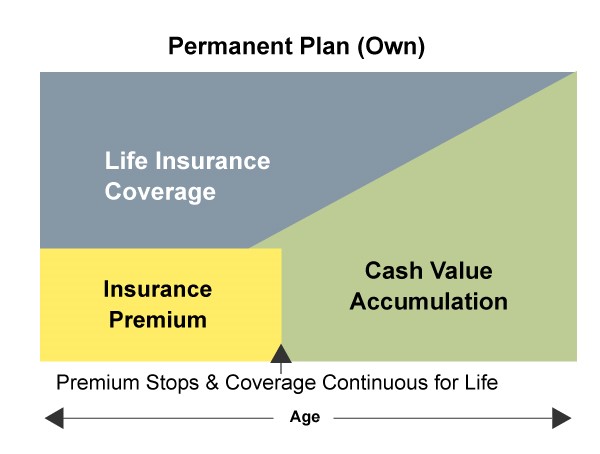

Permanent insurance – which includes “whole” life – is designed to offer coverage no matter when you die (Own it). Even if you stick around into your 90s or 100s, the policy will pay out to your beneficiary. A whole life plan also gains cash value as you pay into it. You can even borrow against it if you need extra cash.

The bottom line is this. You earn money to raise a family. If you disappear tomorrow, the death benefit can replace the income you would have earned for whatever length of time you choose. It gives your family comfort, and it gives you peace of mind.

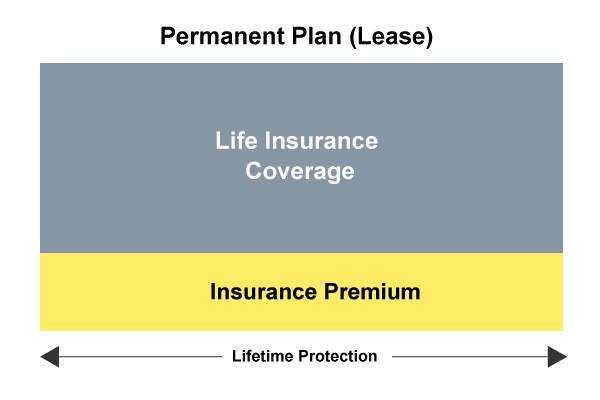

Leasing Life Insurance This plan is guaranteed to pay out at some point in the future. Think of this as a lifelong lease. When leasing a property, you might lock in a 5-year lease. Here you are locking in a rate today (more expensive than the rental option) for the rest of your life.

Highlights:

- Level premium for lifetime

- Coverage never expires

You control the policy: company can’t change or terminate it

Owning Life Insurance The third type of insurance is where you own an equity portion inside the policy. Think of it like owning a house. When you take out a mortgage on a property you pay the bank a monthly amount until your mortgage is paid off and you “own” your house free and clear. With this type of insurance, you pay a monthly/annual premium (higher than the lease option as part of your deposit is invested). Each year, the investment component grows tax-sheltered and that is what you “own”. Think of it as the “equity” in your life insurance, similar to the equity in your home. You can structure the plan to have a “limited” payment period (usually 10-20 years) or choose to pay for life. This “Cash Value” is yours and will continue to grow over time.

Highlights:

- Guaranteed 10, 15 or 20 pay

- Coverage never expires

- Cash values and loan values

You control the policy: company can’t change or terminate it

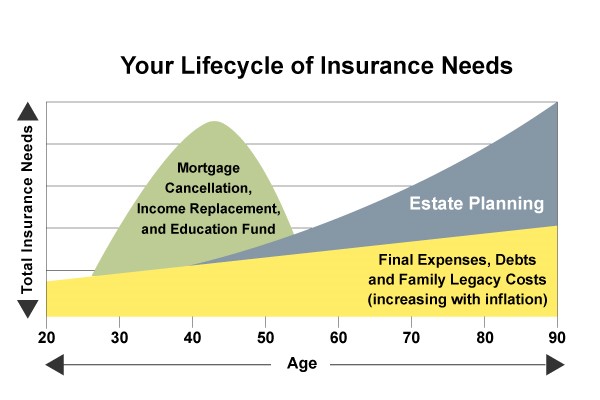

We us a concept called insurance layering. If you have the need for permanent insurance (every one does since every one dies), a need for short term -medium term- and long term TERM insurance then we buy a Permanent policy with a 10 year (young children phase), a 20 year phase (education replacement), and a 30 year phase (covering the mortgage and debts). As time goes forward, each one falls off as the different stages of life pass us by.

As a recap, there are only 3 structures when it comes to life insurance (Rent, Lease, Own). If you would like to discuss this in more detail, please feel free to reach out and we can find a solution that meets your family’s needs.

Download your free copy of this updated brochure.

It covers the following:

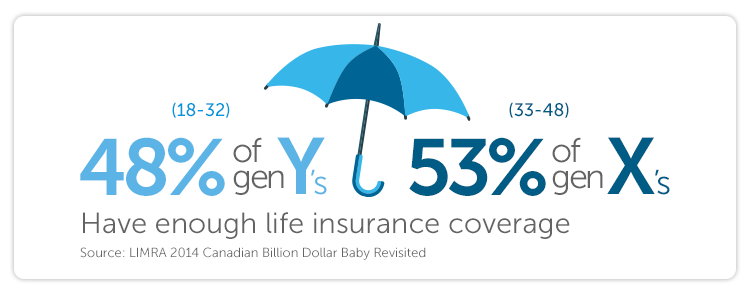

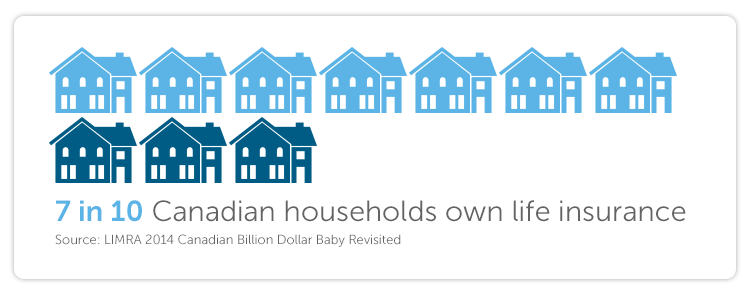

- Why do I need life insurance

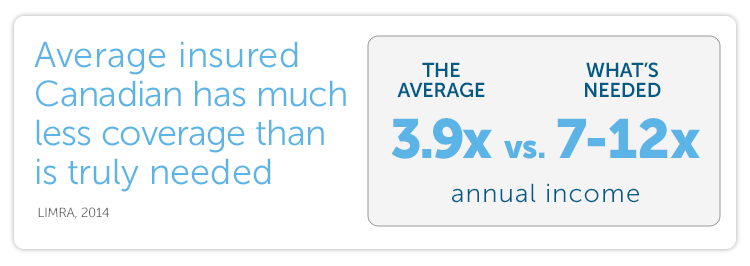

- How much do you need

- What kind should I buy

- How to buy life insurance

At Lang Financial, we service customers across Canada. Primarily, we offer Financial Advice in Southern Manitoba and Northwestern Ontario areas.

I work with Castle Insurance Group Inc.