Protecting yourself and your family

Disability Insurance

Imagine you work for yourself as a house painter. A mosquito lands on your forehead while you are painting. You slap yourself so hard that you knock yourself off the ladder and break three ribs. Doctor says you’ll be out of commission for four months. Ouch…in more ways than one.

Disability insurance kicks in when it becomes clear that the insured person is not capable of performing the core functions of their job due to injury or illness. The insurance policy will pay you a portion of your salary while you recover.

If you have a group insurance policy through your job, you might already have some disability insurance. With group Disability, you can only get a max of 66.67% of your monthly income. This might not be enough for you to make ends meet. Let us take a look at your group plan and help you figure out if you have enough coverage

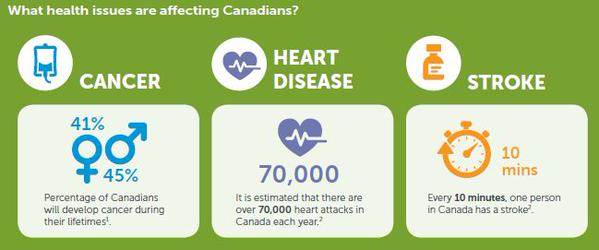

You can use insurance to transfer some of the financial risk of a critical illness from you to them. This can help you continue to make the most of your money, giving you the flexibility to keep your financial plans intact.

Critical illness insurance can help prevent your hard-earned money from being spent on medical bills and associated costs that can arise from an unexpected illness.

At Lang Financial, we service customers across Canada. Primarily, we offer Financial Advice in Southern Manitoba and Northwestern Ontario areas.

I work with Castle Insurance Group Inc.