DIGITAL WEALTH SOLUTIONS

Digital Wealth Solutions for Everyone

Using innovative technology chosen by some of Canada’s largest institutions, Nest Wealth’s digital wealth solutions empower investors to receive access to sophisticated and personalized wealth advice tailored to their unique goals and objectives.

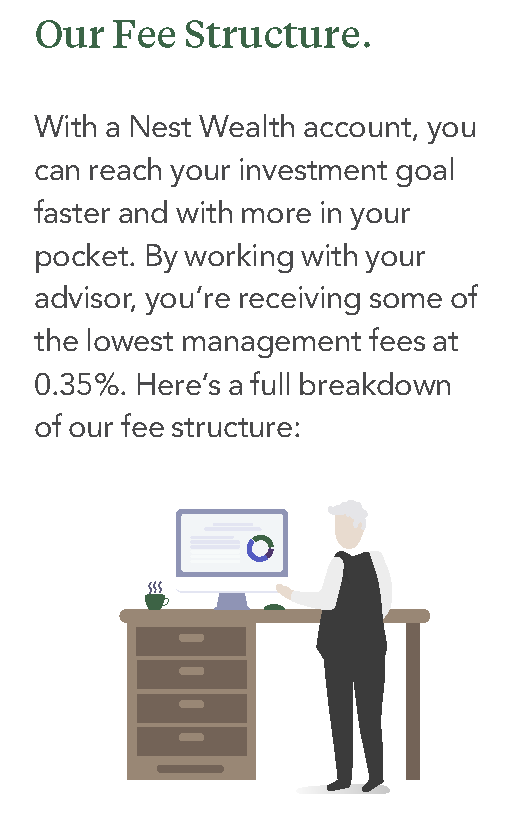

| Type | Cost |

| Investment Management Fee | 0.35% on assets under management (Min of $5 Per Month, Capped at $150 Per Month) |

| Referal Fee | 0$ – $99,999 = 1.00% $100,000 – $249,999 = 0.80% $250,000 – $999,999 = 0.70% $1,00,000 or greater = 0.50% |

| Investment Fees (2) | Average passive management expense ratio (MER) is 0.13%. Active sub-advisory fee is 0.50%. |

Nest Wealth and Steven Lang have a referral arrangement pursuant to which Nest Wealth pays Steven Lang referral fees for introducing clients to Nest Wealth. Nest Wealth and Steven Lang are not affiliated entities, partners, joint ventures, or agents of each other. Nest Wealth is a registered Portfolio Manager and as such, is responsible for delivery of portfolio management services including but not limited to suitability and investment recommendations.

At Lang Financial, we service customers across Canada. Primarily, we offer Financial Advice in Southern Manitoba and Northwestern Ontario areas.

I work with Castle Insurance Group Inc.