Protecting yourself and your family

Critical Illness insurance

Do you know anyone who has had a critical illness?

Of course you do. Did they plan on it? Of course they didn’t. Would a lump sum cash payment help ease the financial strain? That’s easy, YES! Lets discuss how easy this can be.

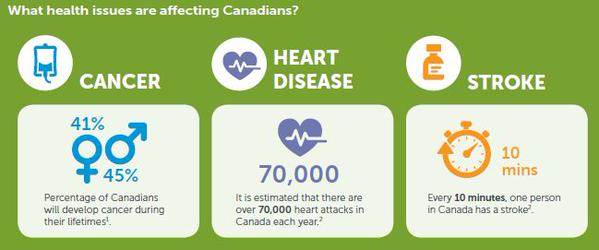

If your application for critical illness insurance is accepted and you get struck with a major health issue – like cancer, stroke, or heart attack – the policy pays out a lump sum (TAX FREE). The idea is that it will replace income while you’re off work and make life easier for you and your family. Also, what if you had to go to the Mayo clinic to get the best care available, would you think twice?

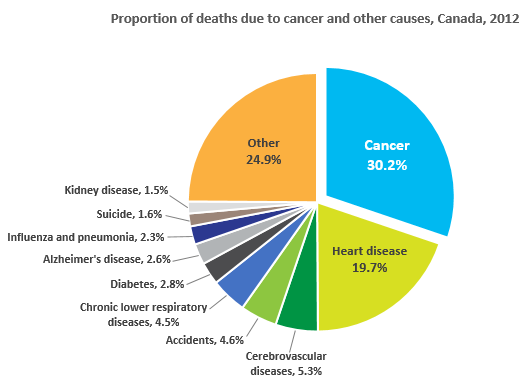

Depending on the insurance package you choose, different medical conditions are covered. Basic plans cover stroke, heart attack, and cancer diagnoses. Some more elaborate plans cover up to 25 different conditions including blindness, deafness, and kidney failure.

Why is it more expensive? Because the odds of it paying out are very high. Think about those you know that have survived a heart attack or cancer. Fast response (everyone has a cell phone to call 911), defibrillators at most offices and sporting facilities and better medicine……. we survive.

The good news is we survive. The bad news is it may result in overwhelming medical, financial and emotional burdens. It also may impact you and your loved ones regardless of your financial position.

Are you prepared to Survive?

You can use insurance to transfer some of the financial risk of a critical illness from you to them. This can help you continue to make the most of your money, giving you the flexibility to keep your financial plans intact.

Critical illness insurance can help prevent your hard-earned money from being spent on medical bills and associated costs that can arise from an unexpected illness.

Critical Illness insurance for children

You may not want to even think about the possibility of your child becoming critically ill, but what if it does happen? Would you want financial resources to:

- Take time off work and be with your child?

- Choose the best care available?

- Focus on your child’s recovery and not other financial concerns?

Many options available with return of premium rider being an easy decision. Returns 100% of your premium at expiry or death. If no claim is made, the expiry of the policy at age 25 will give you full premium back and a possible down payment for a house or a wedding. A great savings plan that works if you need to use it and if you don’t.

Critical illness insurance to protect your business

Because of your hard work, your business is successful. You have savings both personally and inside your company. If you were struck with a critical illness you could easily write a cheque to cover the added healthcare and treatment costs. But while you’re undergoing treatment and recovering, who’s going to look after your business? Who’s going to make sure your products and services are still getting out the door so you still get paid?

In the event you succumb to a critical illness (cancer, heart attack and stroke are most common), a critical illness insurance policy can help keep your business running. This type of coverage doesn’t look after you; it looks after your business.

Contact me to see how we can put the proper insurance in place to protect you and your business.

“When you have cancer, a heart attack or stroke, you go see your ‘physical doctor’ but I hope at that stage you have already made provisions so that your financial health is in place. So when your physical goes, you have financial protection to provide you with that money – which is the promise of insurance and the definition of insurance- when you need it most”

Dr. Marius Barnard – Creator of Critical Illness Insurance

At Lang Financial, we service customers across Canada. Primarily, we offer Financial Advice in Southern Manitoba and Northwestern Ontario areas.

I work with Castle Insurance Group Inc.